6th July. This report is a detailed account of hearings in Vedanta’s appeal against Justice Coulson’s 2016 judgment allowing the case of Zambian villagers polluted by KCM/Vedanta to be heard in the UK, which took place during the 5th and 6th July.

6th July. This report is a detailed account of hearings in Vedanta’s appeal against Justice Coulson’s 2016 judgment allowing the case of Zambian villagers polluted by KCM/Vedanta to be heard in the UK, which took place during the 5th and 6th July.

At 9am on Wednesday 5th of July activists from Foil Vedanta Pan African Society Community Forum (PASCF), Women of Colour in Global Women’s Strike and London Mining Network rallied outside the Royal Courts of Justice with placards and banners calling for justice for thousands of Zambian villagers polluted by Konkola Copper Mines, a subsidiary of UK firm Vedanta Resources PLC. At 10am the court session in Vedanta’s appeal to the May 2016 judgment, which allowed the claimants case to be heard in the UK, began.

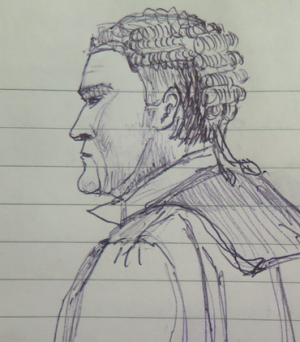

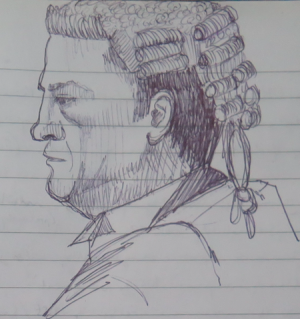

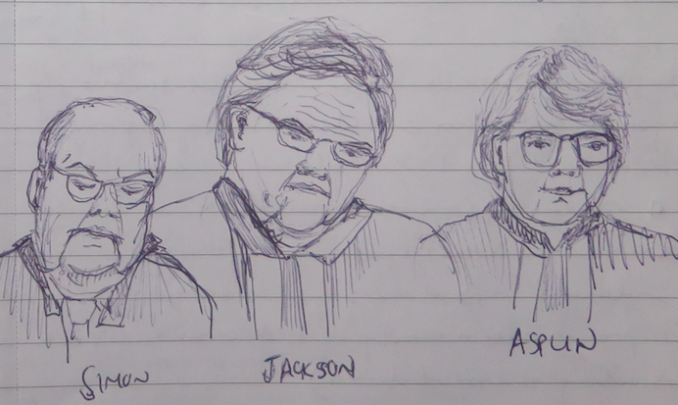

The protesters sat in the public gallery of the small court which was packed with observers and press. In the benches, Vedanta’s legal team consisted of two QCs instructed by ‘magic circle’ corporate law firm Herbert Smith Freehills , as well as three assistants. Behind them Vedanta’s company secretary Deepak Kumar attended along with Geoffrey Green, a non executive director and former partner in law firm Ashurst LLP. On the claimant’s side personal injury firm Leigh Day Solicitors also had two QCs and a number of lawyers and assistants including firm partner Martyn Day sitting at the back. Above them on the judges bench the case was heard by Lord Justice Jackson, Lord Justice Simon and Mrs Justice Asplin.

Wednesday’s hearing was almost entirely taken up with the lengthy appeal plea of Vedanta’s lawyer, Mr Charles Gibson QC. His argument, which we give in detail here, hung on these points:

- That there was no arguable case against Vedanta Resources PLC, and therefore no “gateway jurisdiction” to the English Courts.

- Allowing the use of contractual agreements, policies and reporting requirements, which do not indicate control, to found a duty of care, would allow all British multinationals to be sued in their home state which cannot be in the public interest.

- That Vedanta had agreed to submit to the jurisdiction of Zambia, if a case was bought there.

- That Article 4 of the Brussels Recast Regulation did not automatically allow a UK company to be sued in England and there was always a discretion as to whether they should be allowed to do so.

- That even if the Court found that there was an arguable case against Vedanta, then the Court had still to be satisfied that England was the proper forum in the exercise of its discretion. Zambia was evidently the proper forum and the evidence did not indicate, despite it in some ways being inferior to the English Courts, that substantial justice could not be done there.

No duty of care

Contrary to Vedanta’s narrative at its London AGMs, their lawyer was at pains to point out the lack of corporate governance and expertise held by Vedanta Resources. He repeatedly pointed out that Vedanta Resources is a holding company with eight directors and eleven support staff who meet four times a year (excluding meetings of sub committees), mostly in India, and at times in London. He claimed that there has been no case in England and Wales or the Commonwealth that a parent company is responsible for the actions of its subsidiary to the extent required in this case, and spent a long time picking apart past duty of care cases referred to by Leigh Day, namely Chandler vs Cape and Caparo Industries Limited v Dickman [1990] 2 AC 605, and arguing that they were not relevant in the present case.

Exposing the fallacy of London Stock Exchange ‘rules’ he claimed that there was very little actual oversight of KCM by Vedanta, which is a Zambian firm according to Zambian company law, and he attempted to discredit the claimant’s lawyers’ reliance on Vedanta’s corporate structure and sustainability reports which monitor human rights, environment and health and safety across the company’s global subsidiaries. Amazingly he claimed that these reports were simply a requirement of the London Stock Exchange listing, and did not suggest actual oversight or close involvement with subsidiary operations. He singled out the 2013 Vedanta report Embedding Sustainability, much heralded by Vedanta at that year’s AGM, demonstrating that the improvement in reporting had only come about as a result of conditions placed on Vedanta when it bought Cairn India from UK oil firm Cairn Energy in 2011. A holding company cannot be expected to “micromanage” a Zambian firm, he said.

He claimed that assuming that the existence of overarching company policies and reporting on subsidiaries led to a duty of care created a “perverse situation” in which increased corporate governance could lead to greater liability in legal cases. This idea makes a mockery of the entire concept of corporate governance for British companies, which necessarily includes being liable and accountable for damage caused as a result of your activities.

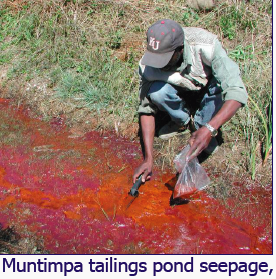

Vedanta’s counsel made repeated warnings to the judges that giving this case UK jurisdiction would open the floodgates to similar cases from claimants affected by British companies all over the world and urged them to “police this gateway” and prevent self interested lawyers signing up claimants using a “vortex of suggestibility”. He went on to suggest that law firms such as Leigh Day would use cases to get wider accountability from companies via group claims for damages. He suggested this was an abuse of the court system turning simple damages claims into a “public inquiry”. In an apparent attempt to whip up fear among the judges he showed satellite images of KCM’s Chingola mines, the River Kafue and other waterbodies, pointing out that if the waterbodies are polluted there could be many more thousands of people with claims against the company who could join the current litigations. He pointed out that there are already two law firms who have filed group claims (Messrs Leigh Day and Hausfeld).

He went on to make the argument that such group claims were expensive and unwieldy and would be a burden to the UK justice system. At this point Justice Jackson intervened asking whether he was taking issue with Group Litigation Orders per say, noting that they are a well established and accepted form of justice. At this intervention Vedanta’s lawyer seemed to get nervous and backtracked considerably, dropping the point from his further arguments.

The lawyer went on to suggest that the claimant’s case was only with KCM, and therefore should be heard in Zambia. At this Judge Jackson intervened again,

“There is the issue that Vedanta may have made substantial profit from KCM, which may now be in financial trouble. If this were the case there would be something wrong with the law if there was no recourse to justice [from Vedanta]”.

Vedanta’s counsel replied by stating that Vedanta itself had agreed to “submit to jurisdiction in Zambia”, and be tried there. This raises the important point as to why Vedanta is so keen to be tried in Zambia and not the UK. Evidence of serious bribery and corruption in previous cases against KCM in Zambia make this very clear. Indeed, the Supreme Court of Zambia took four years and substantial pressure from Foil Vedanta’s London protests to hear KCM’s appeal against the polluted claimant’s 2011 Zambia High Court judgment.

When asked directly by the judge whether KCM was in financial trouble Gibson stated that he had “no idea” whether KCM has any money or not. Company Secretary Deepak Kumar sitting behind him remained straight faced. Interestingly KCM in June announced large profits in Zambia, having previously declared a loss and avoided paying tax (though their accounts and annual reports have never been made public). Conveniently, after last year’s hearing claimed KCM might declare bankruptcy to avoid paying victims in Zambia KCM announced $874 million profits in the 2016/17 tax year.

Undermining the Zambian judiciary

The arguments moved on to whether Zambia or England is the proper forum for the case. Vedanta’s lawyer claimed that mining is a “highly regulated area” in Zambian law subject to various legislation and licenses, and stated that KCM gives weekly samples to the Environmental Council of Zambia (ECZ). As such the case could be tried successfully in Zambia.

He went on to discuss the issue of access to justice in Zambia, and whether Coulson’s judgment was right to assess that there was a real risk that the claimants would not be able to afford or achieve justice there. Gibson claimed that cited cases where justice had not been adequately served (for example the Supreme Court judgment in the case of Nyasulu and others in which 2000 claimants damages were reduced to potential damages awarded to only 12 people) were more likely to be due to incompetence on the part of the Zambian lawyer than a failure of the justice system. Instead he cited several similar cases in which justice had been served in Zambia, including a 2014 case in which 71 claimants in Shimulala and Hippo Pool villages filed for damages against KCM following another water pollution incident and achieved compensation for 52 of the claimants. He produced copies of the 52 cheques in the court and showed them to the judges.

He claimed that NGOs “who are very active in Zambia” often played the role of paying deposits for lawyers or even taking cases themselves on behalf of claimants, noting that in Zambian law they have legal standing to do this. Considering the evidence in our report Northern Governmental Organisations: between the free market and the nation state about the predominantly European and corporate funded nature of most NGOs, with particular reference to Zambia, the idea that NGOs will give Zambians access to justice against a British company is very questionable and undemocratic.

Gibson then cited a list of expert witnesses who had testified to support the credibility of the Zambian justice system. These included former Chief Justice Joseph Sakala, current Solicitor General Abraham Mwansa, a professor and lawyer Professor Mvunga and lawyer Mr Musukwa.

Finally he claimed that trialling this case in the UK will undermine the Zambian judiciary and democracy, saying:

“It is a serious indictment of a foreign country to suggest that its justice system is such that its citizens cannot access justice.. In a slightly colonialist way the learned judge [in the initial judgment] is saying ‘we’re better’ “.

Poor claimants, wealthy appellant

Richard Hermer QC, appearing for Leigh Day on behalf of the claimants began his defence late on Wednesday but made the majority of his argument when the case resumed on Thursday morning.

He described the case as basically being between a wealthy appellant and poor claimants, stating that the general observation of poverty, with resultant lack of access to justice were very important. He then started by highlighting the difficulty in getting KCM accounts, citing the 2014 commercial judgment in London by Justice Eder, and noting that the Zambian government had even entertained freezing KCMs assets in Zambia based on audits of the company Grant Thornton and others in that year.

Before dealing with the main points made by Mr Gibson he spent some time addressing the scope of appeals cases, citing Supreme Court and House of Lord judgments that appeals should be limited to “hard edged legal questions” not rehearing of the evidence.

On the question of duty of care Mr Hermer pointed out that Zambian statutes including the Mines and Minerals Development Act do not limit liability for duty of care to KCM, but can extend it to any person with significant control over operations and cited the statement by former Attorney General Mr Musa Mwenya to that effect. He then demonstrated that Vedanta “operates a high level of control over KCM” and superior operational knowledge and expertise, in particular on environmental practice and policies, which may not be available to KCM. Thus Vedanta cannot be said to be merely a holding company, neither can its overarching policies be said to be simply to fulfil the conditions of LSE listing. As a result “a duty of care can be owed by a parent for its own omissions in respect of damage caused to a claimant”.

He cited several key documents demonstrating this. Firstly, an internal Management Agreement between KCM and Vedanta specifying the services and expertise provided by Vedanta to KCM for the fee of $1 million per year including ‘know how’, technological expertise, employee training, planning, corporate strategy, and consulting services relating to procurement. Secondly, he read various sections from Vedanta’s 2013 sustainability report Embedding Sustainability, highlighting the claimed commitments to ’embed and implement’ various sustainability policies in all subsidiaries and clear lines of responsibility to management. He also noted that the KCM CEO is the only subsidiary executive to have a permanent place on the Sustainability Committee, suggesting the reasons for this will become clear with disclosure of internal documents at trial. This was especially relevant “in context of [historical] systemic environmental failures at the mine and knowledge that it [Vedanta] has of damage it would cause to the class in which the claimants fall”. He also noted that Vedanta’s CEO Tom Albanese is also the Chairman of KCM.

He also cited a witness statement by a KCM manager between 2000 and 2015 called Davies Kakenyela who perceived that Vedanta had ‘all encompassing control’ over operations. He went on to give examples of several cases in which firms’ claims they were ‘just a holding company’ and could not be held responsible for the actions of foreign subsidiaries were rejected, in particular Lubbe v Cape [2000] 1 WLR 1545 the case of an asbestos manufacturer in South Africa sued by workers for damage to health, which did not examine the question of parent liability, and Chandler vs Cape [2012] WLR 3111 – which was the first time as parent was held liable for the actions of its subsidiary because of its superior knowledge of health and safety.

Too poor to access justice

On the issue of appropriate forum for justice Mr Hermer pointed out that this was not the first time a Zambian case has come to the UK noting a previous corruption case (Zambia vs Meer Care and Desai [2008]), and the 2014 commercial case of Brazilian mining contractor U&M against KCM and Vedanta in 2014 in which KCM found it convenient to call in Zambian witnesses and experts “when it suited them”.

On the issue of access to justice Mr Hermer defended his case that there would not be access to justice in Zambia, stating that there are only 545 lawyers in the whole country (1 per 20,000 people), and only 4 in Chingola itself (1 per 40,000 people). Against this he pointed out that the claimants are the ‘poorest of the poor’ in a country where 75% of the population live on less than $1.25/day. Indeed, only 4% of the claimants have ever had a job other than subsistence farming. Taking this into account, along with the lack of legal aid in Zambia, he claimed it was clear that the claimants would struggle to get lawyers.

He then cited seven expert witnesses who testified to the lack of access to justice in Zambia including former Attorney General Musa Mwenya and other Zambian environmental lawyers and NGOs who described their difficulty in lodging or funding cases. This included the statement by the lawyer in the Supreme Court challenge to the Nyasulu and others vs KCM [2015] case Mr Shepande, that he wouldn’t have taken the case had he realised the costs involved, and that he would be unable and unwilling to help the 12 out of 2000 claimants who were finally awarded compensation after an evaluation of damages without further payment. He also cast doubt on the witness statement of ‘environmental lawyer’ Mr Musukwa, who set up his firm in 2015 and has only has one completed case thus far.

On the issue of NGOs funding cases Mr Hermer pointed out that Vedanta’s lawyer had only cited two cases, in which an NGO had given $2000 seed funding, and in which an NGO had funded a single claimant. Instead he listed counter evidence from NGOs on the difficulty of taking cases and the Director of Zambian Legal Aid Board’s statement that even criminal cases often go unfunded, let alone civil cases like this.

At this point Lord Justice Simon intervened asking whether there may not be an advancing skillset among Zambian lawyers and judges which will be jeopardised by “foreign lawyers sweeping in and taking the whole thing away from them?”.

South Africa was a country in which substantial justice could not be obtained, but had developed to such an extent, including with the help of UK lawyers, that you could no longer properly argue that substantial justice could be achieved there.

Poor Vedanta

The case closed with Vedanta’s lawyer Mr Gibson giving his final statement in which he again claimed in strong language that “there is no real prospect of establishing that Vedanta is the operator of the mine as it is unlawful for Vedanta to operate a mine in Zambia” and therefore there is no duty of care and the case should be struck out. He again warned that if this case were allowed to be heard then every holding company would be seen as equally liable as its subsidiaries and claimant cases would flood in to Britain.

“It cannot be the case that every employee and every affected person at any subsidiary world wide is owed the same duty of care...This is not a developing area of the law. It simply doesn’t exist” he said.

He again made the allegation that the case is ‘lawyer led’ and “big business for Leigh Day” citing Leigh Day’s costs of $100 million in the Trafigura case, which were 100% claimed from the company. He claimed that it was unfair to expose Vedanta to such financial risk. Leigh Day’s lawyer rebutted this claim, pointing out that the rules on costs had since been changed and costs would not be as high in this case, though he acknowledged that it would be an expensive case.

Mr Gibson went on to ask that the claimants could take their case against KCM and Vedanta in Zambia, where Vedanta had now agreed to appear. He quoted a witness who described KCM as ‘collaborative’ when giving out payments to the 52 recipients of damages after the 2014 pollution incident, and claimed they had excellent relations with the local community, who they were now being prevented from settling with locally as a result of the ongoing case.

The hearing ended on what is in many ways the most crucial and contentious point for Vedanta – whether KCM is in financial difficulty or not. Mr Hermer claimed that KCM are indeed in difficulty and cited evidence he has to that effect which he will send to the judges. In response Mr Gibson stated that, contrary to claims, KCM have filed annual accounts in Zambia.

The judges thanked the lawyers for excellent arguments, and will deliver their judgment in writing in due course.